Transparency in Legal Services: Impact on Trust and Compliance

- Nurlan Mamedov

- Dec 20, 2025

- 7 min read

Over 65 percent of British clients say they trust law firms more when services are fully transparent. As legal needs grow increasingly complex, especially in the realms of fintech and cryptocurrency, clarity is no longer just a bonus—it is a requirement. Understanding how transparency shapes legal services helps clients and professionals alike identify trustworthy firms, set clear expectations, and avoid costly misunderstandings from the start.

Table of Contents

Key Takeaways

Point | Details |

Importance of Transparency | Transparency in legal services fosters trust and enables informed client decisions by clearly outlining processes, costs, and risks. |

Types of Transparency | Legal transparency includes procedural, financial, operational, strategic, and regulatory aspects that organisations can implement for accountability. |

Client Trust and Engagement | Establishing transparency is essential for building client trust, particularly in high-risk industries where understanding complex regulations is vital. |

Managing Transparency Risks | Balancing transparency with confidentiality is crucial; organisations should implement protocols to protect sensitive information while maintaining clarity. |

Defining Transparency in Legal Services

Legal transparency represents a fundamental principle transforming how professional legal services communicate and operate with clients. Transparency in legal services fundamentally means creating an environment of openness, accountability, and clear communication between legal professionals and their clients.

At its core, transparency involves revealing key processes, expected outcomes, potential risks, and comprehensive fee structures that empower clients to make informed decisions. This approach goes beyond mere information sharing—it establishes a framework of trust where legal professionals demonstrate their methodologies, reasoning, and strategic approach openly. Comprehensive disclosure becomes the cornerstone of building client confidence and maintaining professional integrity.

The principle of transparency extends deeper than surface-level communication. Open justice principles underscore that legal processes should remain accessible, comprehensible, and subject to public scrutiny. For high-risk industries like fintech, gambling, and cryptocurrency, this means providing clear documentation about regulatory compliance, potential legal challenges, and precise steps in licence acquisition or corporate structuring.

Transparent legal services typically demonstrate several key characteristics:

Providing clear, comprehensible fee structures

Offering detailed explanations of potential legal strategies

Maintaining regular, proactive communication channels

Presenting potential risks and challenges candidly

Ensuring documentation is straightforward and jargon-free

Pro Tip for Legal Transparency: Always request a comprehensive initial consultation that breaks down potential legal pathways, associated costs, and realistic outcome probabilities before committing to any legal service engagement.

Types of Transparency in the Legal Sector

Legal transparency encompasses multiple nuanced approaches that organisations can implement to foster trust and accountability. Radical transparency represents the most comprehensive model, involving complete disclosure of organisational processes, decision-making frameworks, and critical information that traditionally remained confidential.

The spectrum of legal transparency ranges from basic procedural disclosure to comprehensive open governance models. Operational transparency includes revealing fee structures, potential legal risks, case management processes, and expected timelines. Strategic transparency goes further by providing insights into legal reasoning, potential challenges, and comprehensive risk assessments that empower clients to make informed decisions.

Moreover, open government principles significantly influence legal sector transparency, advocating for unrestricted access to documentation, proceedings, and policy frameworks. This approach is particularly critical in high-risk industries such as financial services, cryptocurrency, and online gambling, where regulatory compliance and clear communication become paramount for maintaining operational legitimacy.

Key types of legal sector transparency include:

Procedural Transparency: Revealing step-by-step legal processes

Financial Transparency: Clear fee structures and billing practices

Operational Transparency: Detailed insights into case management

Strategic Transparency: Sharing legal reasoning and potential risks

Regulatory Transparency: Comprehensive compliance documentation

Pro Tip for Legal Sector Transparency: Always request a detailed engagement letter that explicitly outlines the scope of services, potential limitations, expected outcomes, and a comprehensive breakdown of potential costs and risks before initiating any legal engagement.

To clarify how varying degrees of transparency impact both legal clients and firms, see the comparison below:

Transparency Degree | Client Benefit | Firm Benefit |

Minimal (Procedural only) | Basic awareness of legal steps | Lower risk of exposing sensitive data |

Moderate (Fee & Risk) | Cost clarity and risk understanding | Reduced client disputes, easier planning |

Full (Strategic & Open) | Maximised trust and informed choices | Strong reputation, higher engagement |

Why Transparency Builds Client Trust

Client trust represents the fundamental cornerstone of successful legal services, with transparency serving as the critical mechanism for establishing and maintaining meaningful professional relationships. Legal service transparency fundamentally eliminates client doubts by creating an environment of openness, respect, and comprehensive communication about processes, potential outcomes, and associated costs.

In high-risk industries such as fintech, cryptocurrency, and online gambling, transparency becomes even more crucial. Clients seek reassurance that their legal representatives understand complex regulatory landscapes and can navigate potential challenges with precision and integrity. By proactively sharing detailed insights into legal strategies, potential risks, and comprehensive fee structures, legal professionals transform transactional relationships into trusted partnerships built on mutual understanding and clear expectations.

Moreover, regulatory frameworks increasingly mandate transparency as a fundamental requirement for legal service providers. These frameworks recognise that informed clients make better decisions, leading to improved satisfaction and reduced potential for disputes. Transparency demonstrates a commitment to ethical practice, professional integrity, and client empowerment through comprehensive information sharing.

Key elements that build client trust through transparency include:

Providing clear, upfront fee structures

Explaining potential legal strategies and risks candidly

Maintaining regular, proactive communication

Offering comprehensive documentation

Demonstrating expertise through detailed insights

Pro Tip for Building Trust: Always schedule an initial consultation that includes a comprehensive breakdown of potential legal pathways, associated risks, expected timelines, and a transparent discussion of potential costs before formalising any legal engagement.

Transparency’s Role in Regulatory Compliance

Regulatory compliance represents a complex landscape where transparency serves as the fundamental mechanism for demonstrating organisational integrity and adherence to established legal frameworks. Role of regulators in fintech highlights the critical importance of clear, comprehensive documentation and communication in navigating increasingly sophisticated regulatory environments.

In high-risk industries such as cryptocurrency, online gambling, and financial technologies, transparency becomes more than a procedural requirement—it transforms into a strategic imperative. Organisations must proactively disclose their operational methodologies, risk management strategies, and comprehensive compliance protocols. This approach not only satisfies regulatory mandates but also builds essential trust with stakeholders, including regulators, investors, and clients who demand sophisticated understanding of complex legal and operational frameworks.

The mechanisms of regulatory compliance through transparency involve multiple interconnected dimensions. Companies must develop robust reporting systems that provide real-time insights into their operational practices, financial transactions, and risk mitigation strategies. These systems must be designed to demonstrate continuous compliance, allowing regulatory bodies to conduct efficient assessments and verify organisational commitment to established legal standards.

Key elements of transparency in regulatory compliance include:

Comprehensive and timely reporting

Detailed documentation of operational processes

Clear risk management frameworks

Proactive disclosure of potential compliance challenges

Systematic approach to regulatory updates and adaptations

Pro Tip for Regulatory Compliance: Develop a dynamic compliance management system that allows for real-time tracking, immediate reporting, and rapid adaptation to emerging regulatory requirements across multiple jurisdictions.

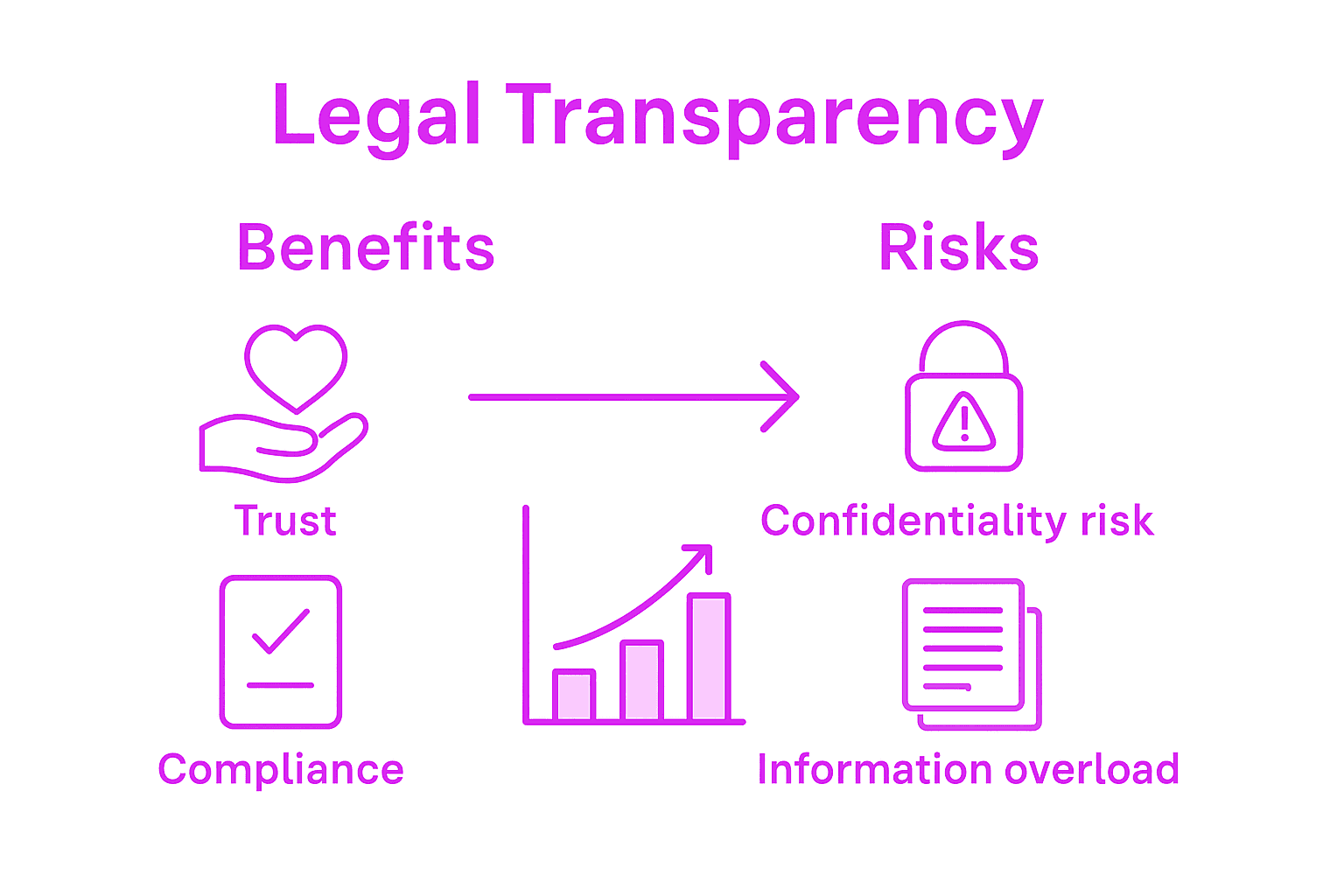

Risks and Challenges in Transparent Practice

Transparent legal practices require carefully navigated strategies that balance comprehensive disclosure with protecting sensitive organisational information. Governance frameworks addressing systemic opacity highlight the nuanced challenges of maintaining institutional trust while managing potential vulnerabilities in information sharing.

In high-risk industries such as fintech, cryptocurrency, and online gambling, transparency introduces complex risks that demand sophisticated management approaches. Legal professionals must carefully calibrate their disclosure strategies, recognising that excessive transparency could potentially expose strategic vulnerabilities, compromise ongoing negotiations, or provide competitors with unintended insights into operational methodologies. The delicate balance involves sharing sufficient information to build trust while protecting critical commercial and strategic interests.

The primary challenges of transparent practice emerge from multiple interconnected dimensions. Organisations must develop robust information management protocols that distinguish between essential disclosures and sensitive strategic content. This requires sophisticated legal expertise to navigate regulatory requirements, client confidentiality expectations, and commercial sensitivity. Potential risks include inadvertent revealing of proprietary strategies, compromising ongoing legal negotiations, and potentially creating legal exposure through overly comprehensive documentation.

Key risks in transparent legal practice include:

Potential exposure of strategic business information

Inadvertent disclosure of confidential client details

Compromising ongoing legal negotiations

Creating unintended legal vulnerabilities

Revealing sensitive competitive intelligence

Pro Tip for Managing Transparency Risks: Implement a comprehensive information review protocol that systematically assesses potential risks before disclosure, ensuring that transparency supports trust without compromising organisational strategic integrity.

For a succinct overview, here are the main transparency challenges alongside real-world implications for legal firms:

Challenge | Impact on Legal Practice | Mitigation Strategy |

Over-disclosure of information | Possible loss of competitive edge | Implement confidentiality protocols |

Managing sensitive client data | Increased legal liability | Enforce strict data control procedures |

Balancing trust and secrecy | Compromised negotiations | Regular risk assessments before sharing |

Achieve Legal Transparency and Compliance with Confidence

Navigating the complexities of transparency in legal services is essential for building client trust and meeting strict regulatory demands. If you operate within high-risk sectors such as fintech, cryptocurrency, or online gambling, understanding how clear communication, comprehensive disclosure, and strategic transparency influence your licence acquisition and ongoing compliance can make all the difference. Address challenges like balancing openness with confidentiality while maintaining regulatory integrity with expert guidance.

Partner with NUR Legal, specialists in providing clear and reliable legal solutions tailored for regulated industries. From securing crypto licences in Georgia and Seychelles to full gaming licences in Curaçao or Anjouan, we ensure all compliance procedures are transparent, thorough, and designed to protect your business interests. Take the first step towards building lasting client trust and regulatory compliance by exploring our comprehensive legal consultancy services today. Empower your business with legal clarity and act now to establish a compliant, trustworthy foundation in complex markets.

Frequently Asked Questions

What is transparency in legal services?

Transparency in legal services refers to the practice of clear communication and openness between legal professionals and clients, including disclosing processes, expected outcomes, potential risks, and fee structures to foster informed decision-making.

How does transparency build client trust in legal services?

Transparency builds client trust by creating an environment of openness and comprehensive communication about legal strategies, associated costs, and risks, allowing clients to make informed choices and develop a partnership based on mutual understanding.

What are the different types of transparency in the legal sector?

Types of transparency in the legal sector include procedural transparency (revealing legal processes), financial transparency (clear fee structures), operational transparency (case management insights), strategic transparency (legal reasoning), and regulatory transparency (compliance documentation).

What risks are associated with pursuing transparency in legal practices?

Risks associated with transparency include the potential exposure of sensitive strategic information, inadvertent disclosure of confidential client details, compromising ongoing negotiations, and creating legal vulnerabilities through excessive information sharing.

Recommended

Comments